2022 phthalic anhydride market presents "M" trend overall price rise

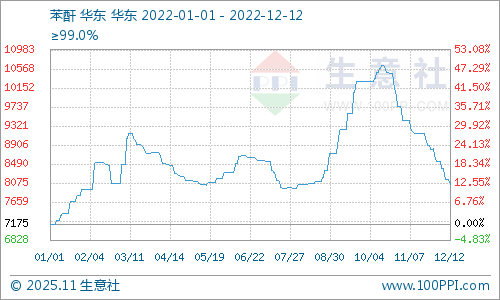

According to statistics, the overall price of domestic anhydride rose in 2021, the price was 7175 yuan/ton at the beginning of the year, and the price was 8050 yuan/ton on December 12. In 2022, the price of anhydride rose by 12.20%. The highest price appeared on October 16, the highest price was 10637.5 yuan/ton, and the lowest price appeared on January 1. The lowest price is 7175 yuan/ton, and the maximum amplitude within the year is 48.26%.

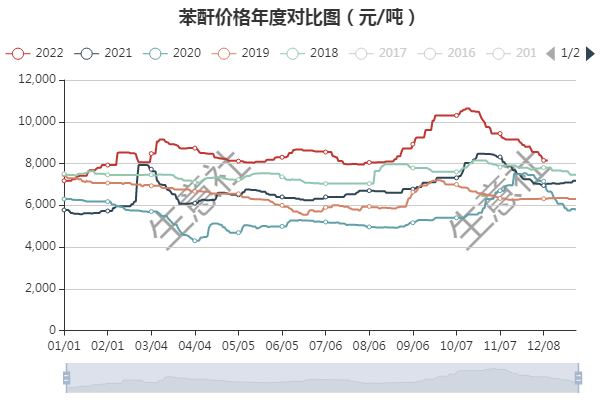

As can be seen from the domestic price chart of phthalic anhydride in the past five years, the price of phthalic anhydride in 2022 is at a high level, and the high market price of phthalic anhydride generally appears in the fourth quarter. In the second quarter, the market price trend of phthalic anhydride has declined, and the market price of phthalic anhydride in 2022 has risen. It can be seen from the chart that the price trend of anhydride is roughly divided into four stages. The first stage is from the beginning of the year to mid-March, when the price of anhydride rises. The second stage is from late March to the end of July, the anhydride market shock down period; The third stage is from early August to mid-October, when the price of phthalic anhydride rises rapidly. The fourth stage from late October to December 12, the market price of phthalic anhydride decreased significantly.

In the first stage, from the beginning of the year to the middle of March, the domestic market price of phthalic anhydride rose. From 7175 yuan/ton at the beginning of the year, the price rose to 9150 yuan/ton in mid-March, an increase of 27.53%. The domestic anhydride market rose sharply, first of all, the domestic anhydride manufacturers start to maintain a low level, the field of anhydride operating rate in more than 5, the domestic spot supply of anhydride slightly nervous, the price of the field of anhydride, the downstream plasticizer industry rose sharply, the actual transaction is obviously good, the market price of anhydride rose. Secondly, the price of upstream raw benzene rose sharply, the domestic market price of benzene rose from 6300 yuan/ton to 9000 yuan/ton, an increase of 42.86%, in addition to the port area imports of benzene prices rose sharply, high price of phthalic anhydride, upstream raw benzene prices rose sharply to form cost support for the market, the market price of phthalic anhydride rose sharply.

The second stage is from late March to the end of July, the anhydride market shock down period. In late March, the price was 9,150 yuan/ton, which dropped to 7,950 yuan/ton at the end of July, down by 13.11%. Domestic phthalic anhydride manufacturers started a slight increase, the opening rate of the floor rose to about 6 percent, the sufficient supply of domestic phthalic anhydride spot, phthalic anhydride floor wait-and-see mentality remains, phthalic anhydride market to take the general situation, phthalic anhydride market price trend decline. In addition, the price trend of the upstream raw material phthalic acid fell sharply, the downstream DOP market trend fell, the plasticizer market decreased, the procurement is not good, and the negative factors superposition led to the market price of phthalic anhydride continued to decline.

The third stage is from early August to mid-October, when the price of phthalic anhydride rises rapidly. The market price of phthalic anhydride increased by 33.81% from 7950 yuan/ton in early August to 10637.5 yuan/ton in mid-October. At this stage, the domestic market price of phthalic anhydride continued to rise. At this stage, the supply of domestic phthalic anhydride was tight, some devices started unstable, the supply of goods received certain restrictions, and the operating rate of phthalic anhydride was about 50%. Domestic spot supply of phthalic anhydride is tight, at this stage the factory almost no inventory, manufacturers go smoothly, order scheduling situation, serious contradiction between supply and demand leads to the rising market price of domestic phthalic anhydride. Coupled with the recent supply of raw benzene, phthalic anhydride manufacturers purchasing difficulties, phthalic anhydride manufacturers lack of enthusiasm to start work, factory production maintenance more, phthalic anhydride supply shortage, resulting in phthalic anhydride manufacturers raw materials tight, limited the production of manufacturers, plus phthalic anhydride prices high, favorable factors support, the price of phthalic anhydride rose sharply. The market price of the downstream DOP rose sharply, and the downstream demand was good. At this stage, the price of the DOP rose by 14.51%. The customers actively purchased the products, and the market price of the phthalic anhydride increased significantly.

The fourth stage from late October to December 12, the market price of phthalic anhydride decreased significantly. Anhydride price from 10637.5 yuan/ton down to 8050 yuan/ton at the end of the year, down 24.32%, the market price of anhydride fell sharply, the floor of the anhydride goods situation is not good, the recent increase in the supply of anhydride, part of the domestic overhaul device restart, Anhui Tongling phthalic anhydride began normal shipments, Xinyang Group 100000 tons of phthalic anhydride device stable operation, Affected by the restart of the device, the domestic operating rate of anhydride rose to about 6 percent, the serious surplus of domestic anhydride production capacity, sufficient supply of anhydride, the market price is low. This stage of the downstream plasticizer industry market is weak, the actual transaction situation is not good. Upstream benzene situation decline, coupled with the plasticizer industry market downturn, sluggish demand, phthalic anhydride market prices fell sharply.

Overall, the domestic market trend of phthalic anhydride will rise in 2022. The price trend of phthalic anhydride is similar to that of phthalic anhydride. The downstream plasticizer industry is a direct factor affecting the price of phthalic anhydride.

Future market forecast: Serious overcapacity in the domestic anhydride market, coupled with naphthalene method of anhydride production capacity, phthalic anhydride by a certain pressure, coupled with the two years of real estate market is not optimistic, the plasticizer industry is affected by a certain amount, the demand has not increased significantly, but the fourth quarter of the year is the peak season for the demand of the plasticizer industry, with the increase of anhydride production capacity, 2023 The average price of anhydride or lower than 2022, 2023 is expected to be the highest market price of anhydride or still in the fourth quarter, the highest price is about 9500 yuan/ton, the lowest price or will appear in the second quarter, the lowest price is about 6000 yuan/ton.